- Daily Dispatch

- Posts

- The 15% Bitcoin and gold rule 💰

The 15% Bitcoin and gold rule 💰

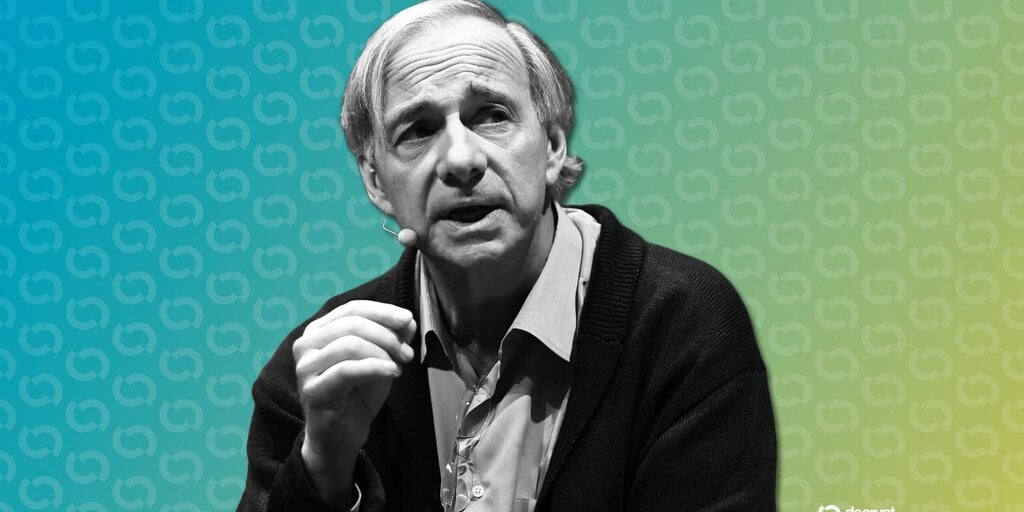

Bridgewater founder Ray Dalio, who predicted the 2008 financial crisis, is now advising investors to allocate 15% to Bitcoin and gold.

📝 What you need to know

The same billionaire hedge fund founder who predicted the 2008 financial crisis is linking Bitcoin’s recent rise to a “debt-fueled heart attack” in the U.S. and cautioning investors to keep 15% of their portfolios in Bitcoin and gold.

Bridgewater founder Ray Dalio told Financial Times this is the “traumatic last phase” of a “big debt cycle,” where over the course of history, excessive debt has culminated in an economic contraction and systemic crisis.

But investors haven’t been waiting on the OK from Dalio to buy in.

Bitcoin and gold have surged this year. The precious metal’s price has increased 38% year-to-date, hitting an all-time high of $3,530 per ounce Wednesday, according to Trading Economics. Bitcoin’s price has increased 20% to $112,000 over the same period, according to crypto data provider CoinGecko.

📊 Myriad Market of the Day

😂 Meme of the Day

🥇 Be First to Market With Myriad

Join the Myriad Markets Telegram to see the latest prediction markets the second they drop!

With Myriad, the on-chain prediction market launched by Decrypt’s parent company DASTAN, you can break the news and stake the news, using USDC and points.

🕵🏻♀️ Editor’s Picks

📚 Watch and Learn

Interested in partnering with Decrypt? Find out more here.