- Daily Dispatch

- Posts

- Market structure restructuring ↔️

Market structure restructuring ↔️

Horse-trading over the Clarity Act continued as banks secured a win over stablecoin yield, while a draft provision carved out a "non-ancillary" legal status for tokens like XRP.

📝 What you need to know

Horse-trading over the Clarity Act continued on Capitol Hill this week, with the markup of the crypto market structure legislation in the Agriculture Committee pushed back to late January.

Banks secured a key win in the fight over stablecoin yield, with an updated draft blocking digital asset service providers from paying “any form of interest of yield” solely for holding payment stablecoins—though exemptions apply for activty-based rewards.

Meanwhile, a draft provision created a “non-ancillary” legal states for crypto assets that were part of a listed ETF as of January 1, 2026—effectively giving assets including XRP, Dogecoin and Solana a regulatory status akin to that of Bitcoin and Ethereum.

📰 In the News

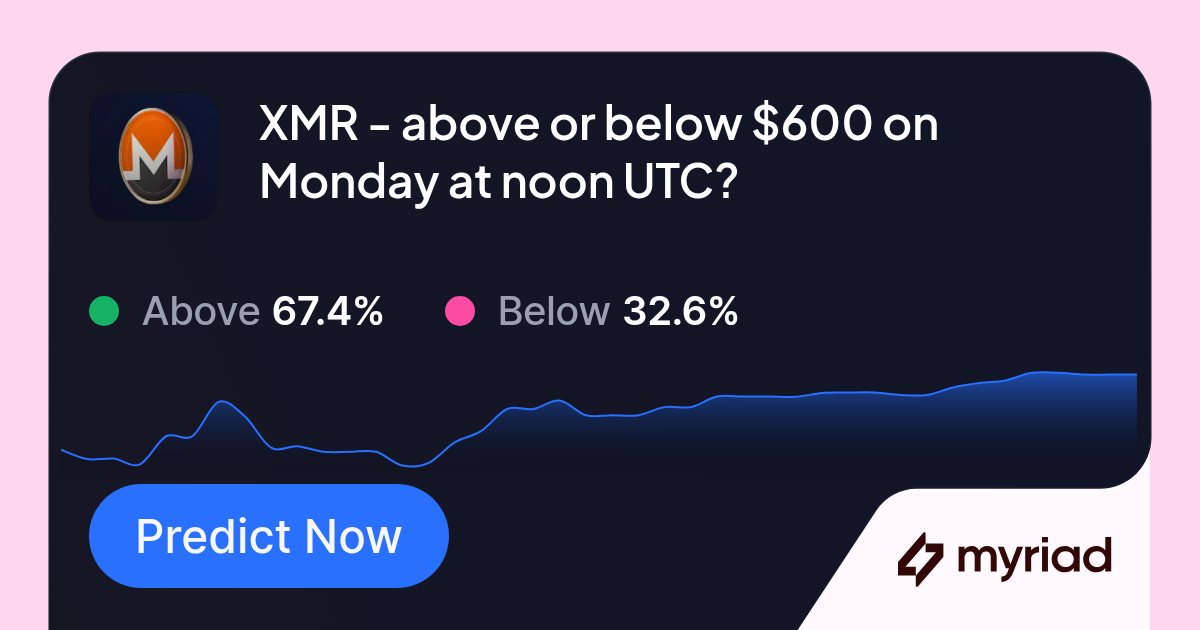

📊 Myriad Market of the Day

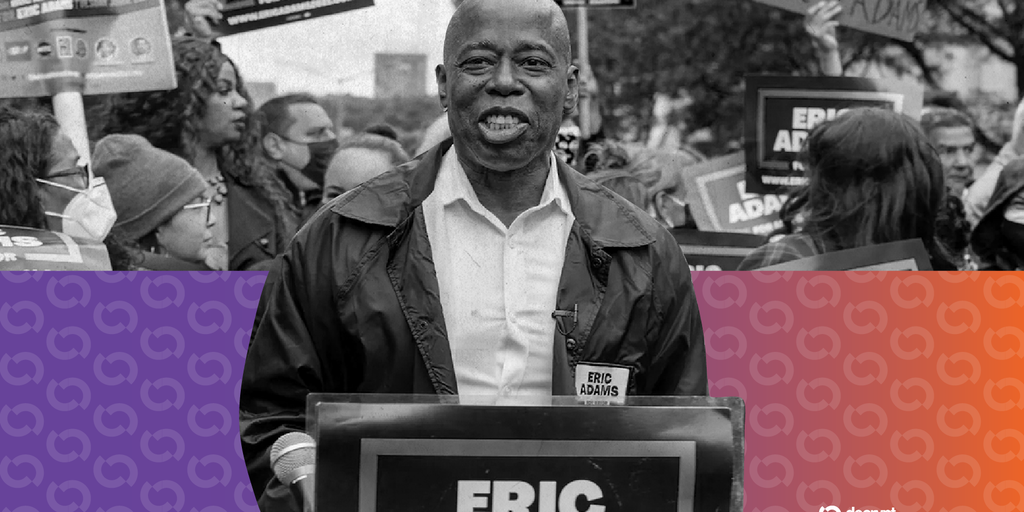

😂 Meme of the Day

🥇 Be First to Market With Myriad

Join the Myriad Markets Telegram to see the latest prediction markets the second they drop!

With Myriad, the on-chain prediction market launched by Decrypt’s parent company DASTAN, you can break the news and stake the news, using USDC and points.

🕵🏻♀️ Editor’s Picks

📚 Watch and Learn

Interested in partnering with Decrypt? Find out more here.