- Daily Dispatch

- Posts

- Exit (Micro)Strategy 🟠

Exit (Micro)Strategy 🟠

Bitcoin-happy software firm MicroStrategy made a splash with its rebrand as Strategy—and dropped its Q4 earnings hours later, with a net loss of $670.8 million for the quarter.

Together with:

📝 What you need to know

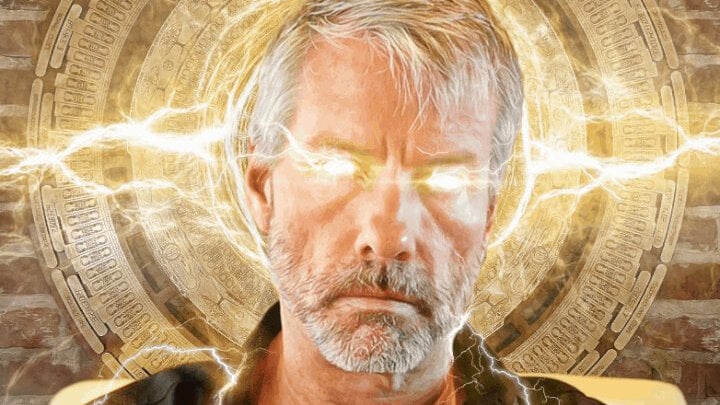

MicroStrategy is no more: the software firm set tongues wagging with a splashy announcement that it was rebranding as simply “Strategy,” with co-founder and Bitcoin bull Michael Saylor touting the name as “one of the most powerful and positive words in the human language.”

While Crypto Twitter was busy debating the rebrand (and making the same joke over and over) the company dropped its Q4 earnings report, posting a net loss for the quarter of $670.8 million, an order of magnitude larger than the $89.1 million loss posted for the same period in 2023.

Still, Saylor may yet have the last laugh, with its expenditures going towards growing its vast Bitcoin stockpile—purchased for an average price of $62,503 at the end of 2024, and now worth just shy of $100,000 a pop.

💬 Quote of the Day

“It’s only digital gold if it has a use. If it doesn’t have a use, it’s just paper. Not paper, it’s air, not even air.”

From our partner

Introducing Grayscale Bitcoin Miners ETF (ticker: MNRS). MNRS provides exposure to Bitcoin Miners and the global Bitcoin Mining industry at a time when we’re seeing unprecedented interest and growth in Bitcoin.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (866)-775-0313 or visit our website at etfs.grayscale.com/mnrs. Read the prospectus or summary prospectus carefully before investing. MNRS is distributed by Foreside Fund Services, LLC and Grayscale Advisors, LLC is the adviser.