- Daily Dispatch

- Posts

- Ethereum ETF "aftershocks" ⚠️

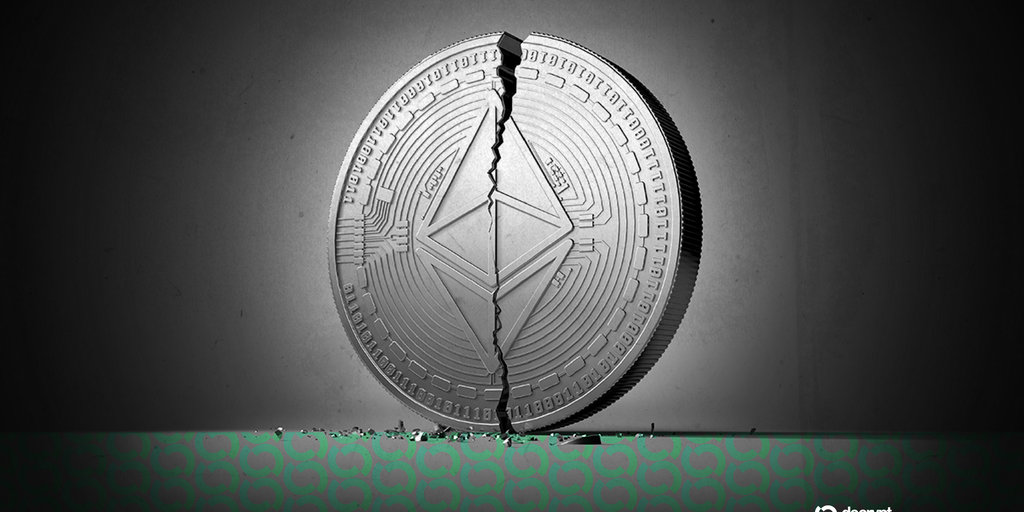

Ethereum ETF "aftershocks" ⚠️

U.S. spot Ethereum ETFs shed $429 million Monday, in a "macro reflex" following Friday's crypto market liquidations.

Together with

📝 What you need to know

U.S. spot Ethereum ETFs shed $428.5 million Monday, their largest single-day outflow in five weeks—reversing last week’s surge in inflows in the wake of Friday’s massive crypto liquidation event.

Speaking to Decrypt, analysts called the exodus the “aftershocks from Friday’s tariff-driven selloff,” arguing that while the market has turned “defensive” with short-term macro jitters, last weeks inflow’s point to institutional positioning remaining intact. Nevertheless, they said, many investors are “preferring to wait for clearer macro signals before stepping back in.”

From our partner

Trade to win! Deposit and trade Futures on MEXC to for a chance to win an iPhone 17, Rolex, and more from a $15,000 prize pool. First to qualify, first to win. MEXC offers 2,700+ coins, 500x leverage, top 10 liquidity, fast listings, and global access with no KYC for most users.

📰 In the News

📊 Myriad Market of the Day

💬 Quote of the Day

“While short-term volatility persists—potentially pushing Bitcoin toward $100,000 support and Ethereum to $3,600—we see this as a healthy correction that clears weak hands and sets the stage for renewed accumulation.”

🥇 Be First to Market With Myriad

Join the Myriad Markets Telegram to see the latest prediction markets the second they drop!

With Myriad, the on-chain prediction market launched by Decrypt’s parent company DASTAN, you can break the news and stake the news, using USDC and points.

🕵🏻♀️ Editor’s Picks

📚 Watch and Learn

Interested in partnering with Decrypt? Find out more here.