- Daily Dispatch

- Posts

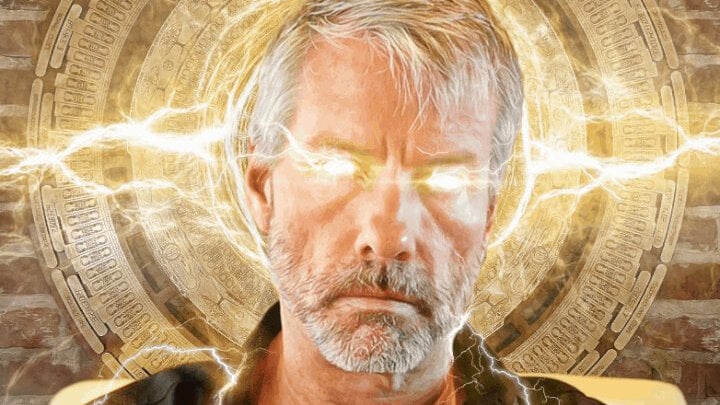

- A spicy Bitcoin bet 🌶️

A spicy Bitcoin bet 🌶️

Leveraged ETFs built around the stock of Bitcoin giant MicroStrategy are risky—and in serious demand.

IN PARTNERSHIP WITH

📝 What you need to know

Bitcoin and stocks are on the rise since last week’s long-awaited Fed rate cuts, pointing to a returning appetite for risk assets. But some investors appear to be seeking a much spicier kind of risk, based on the early returns.

New leveraged ETFs built around the stock of MicroStrategy—Michael Saylor’s software company that has the largest Bitcoin treasury reserve stash on Earth, valued at $16.5 billion currently—are booming, collectively attracting over $400 million and landing in the top 20% of new ETFs this year in terms of assets under management.

MicroStrategy (MSTR) has long been seen as a proxy stock for Bitcoin, well before the SEC approved Bitcoin ETFs, but these leveraged MSTR ETFs are expected to be extremely volatile—Bloomberg’s ETF analyst called them the “ghost pepper of ETF hot sauce” when first revealed. Hey, some like it hot.

From Our Partner

Galaxis's goal is to empower individuals to build an unstoppable community that’s truly their own, freeing them from third-party control. With a no-code platform, users can monetize their creativity, protect their digital spaces from deplatforming, and achieve true digital sovereignty.

Discover the cutting-edge infrastructure behind the iconic Trump NFTs! Explore how our technology powers the future of digital collectibles and stay ahead of the curve.